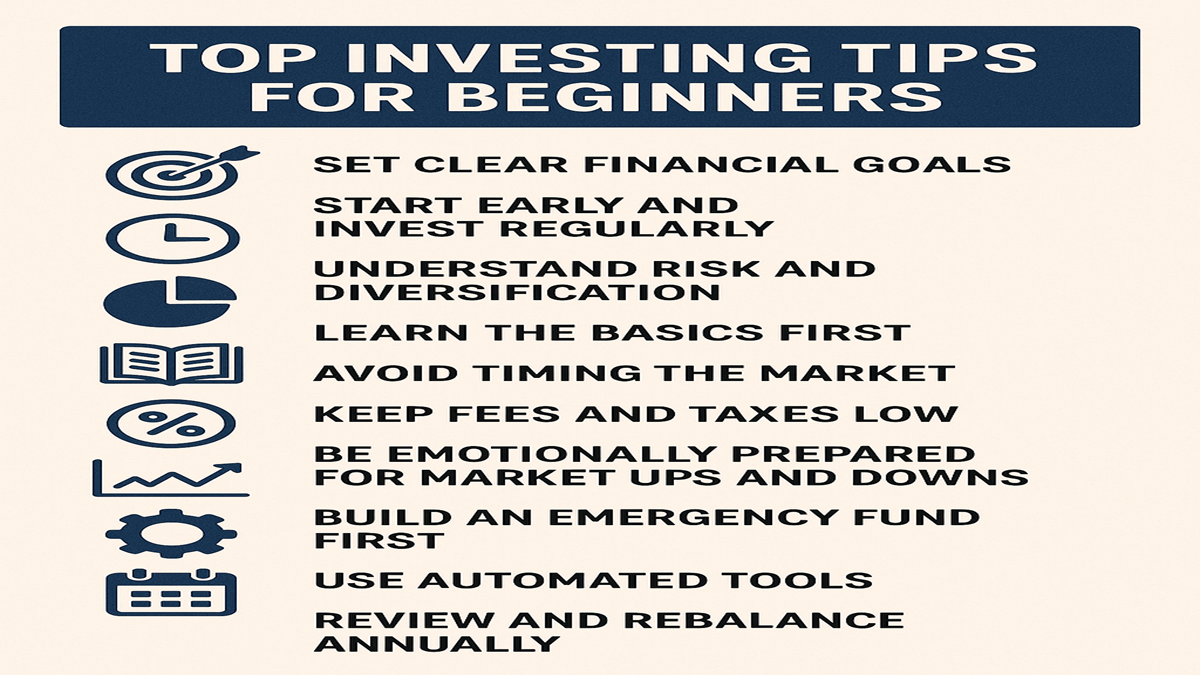

Top investing tips for beginners to help you build a strong foundation and avoid common pitfalls:

1. Set Clear Financial Goals

- Short-term vs. long-term: Know whether you’re investing for retirement, a home, education, or another goal.

- Match your investment choices to your time horizon and risk tolerance.

2. Start Early and Invest Regularly

- Time is your biggest ally: The power of compound interest works best over the long term.

- Use dollar-cost averaging (investing a fixed amount regularly) to reduce the impact of market volatility.

3. Understand Risk and Diversification

- Don’t put all your eggs in one basket. Spread your investments across asset classes (stocks, bonds, real estate, etc.).

- Consider index funds or ETFs for instant diversification.

4. Learn the Basics First

- Understand key concepts: stocks, bonds, mutual funds, ETFs, dividends, expense ratios, etc.

- Read reputable books, blogs, and watch videos (like “The Little Book of Common Sense Investing” by John Bogle).

5. Avoid Timing the Market

- Even professionals struggle to do this consistently.

- A buy-and-hold strategy often outperforms short-term trading.

6. Keep Fees and Taxes Low

- Choose low-cost index funds or ETFs over high-fee mutual funds.

- Consider tax-advantaged accounts like IRAs or 401(k)s if available.

7. Be Emotionally Prepared for Market Ups and Downs

- Markets fluctuate—don’t panic sell during downturns.

- Stick to your long-term plan unless your financial situation or goals change.

8. Build an Emergency Fund First

- Before investing, have 3–6 months of expenses in a liquid, safe account (like a high-yield savings account).

9. Use Automated Tools

- Consider robo-advisors (like Betterment or Wealthfront) for hands-off investing.

- Set up automatic transfers to make saving and investing easier.

10. Review and Rebalance Annually

- Over time, your portfolio can drift from your target allocation.

- Rebalancing helps maintain your desired risk level.